nh property tax rates by town 2019

Tax Rates General Information. 240 rows 2019 New Hampshire Property Tax Rates click or tap markers on map below for more info.

8 Signs It S Finally Time To Hire A Pro To Do Your Taxes Don T Wait Toot Is To Late Get Expert Advice B D Tax A Diy Taxes Real Estate Tips Types

The following table sets forth the Citys tax rate by City School and County for each of the last five fiscal years.

. The Town ClerkTax Collector has the responsibility of collecting property yield gravel and timber current use change taxes and sewer payments. Tax Rates are given in dollars per one thousand dollars of assessed value. Click column headers to sort.

Concord City Hall 41 Green Street Concord NH 03301 Phone. The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. 1 Rates are based on assessed value of property.

The Town portion of the tax rate remained constant at 657. Tax Collector Business Hours Monday Wednesday 830AM. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes.

When combining all local county and state property taxes these towns have the highest property tax rates in New Hampshire as of January 1 2022. Tax Rate History. Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts.

Annual Town Reports and Meetings. 236 rows town total 2020 tax rate change. NH Property Tax Rates by Town 2019.

In New Hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. The exact property tax levied depends on the county in new hampshire the property is located in. 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009.

Property Tax Rates Related Data. 2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate. 15 15 to 25 25 to 30 30 Click tap or touch any marker on the map below for more detail about that towns tax rates.

Property tax bills are due semi. Understanding New Hampshire Property Taxes. Town Total Tax Rate Total.

New Hampshire has one of the highest. Hanover Town Hall PO Box 483 Hanover NH 03755 603 643-0742. Town Offices Appointed.

Annual Town Report. Tax amount varies by county. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment 1 200000 200000 000 000 000 Campton 112219.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Town of Plaistow New Hampshire 145 Main Street Plaistow NH 03865 Phone. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration.

Property Tax Year is April 1 to March 31. 236 rows town total 2020 tax. Assessment rate for real.

603 382-7183 Website Disclaimer Government Websites by CivicPlus. View current and past tax rates. Valuation Municipal County State Ed.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic. Hudsons share of the county tax burden for 2005 was approx.

Wondering How Much You Should Put Towards A Downpayment Overwhelmed With About A Hundred Other Questions Relate In 2022 Buying Your First Home House Hunting Homeowner

Average Faculty Salary By Sector Over Time Trends In Higher Education The College Board College Board Faculties Higher Education

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Home Prices Up 5 05 Across The Country Infographic House Prices Real Estate Infographic Best Places To Retire

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Fha Debt To Income Ratio

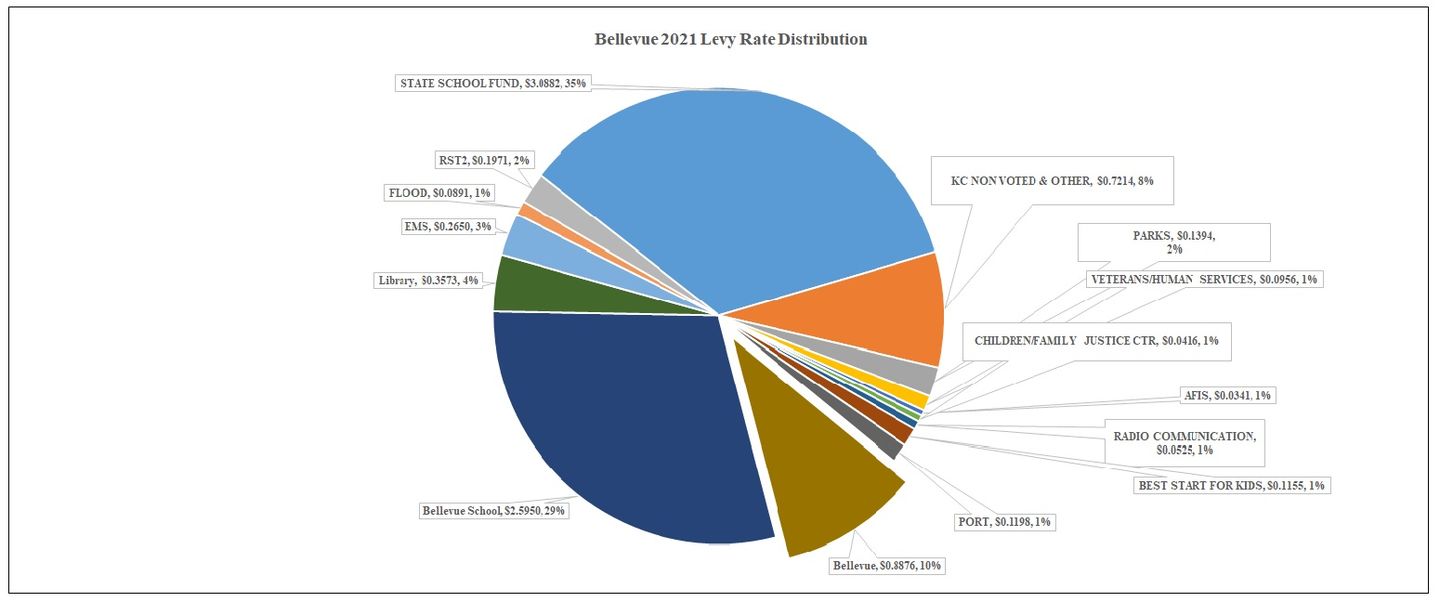

Bellevue Property Taxes City Of Bellevue

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

Tuition And Fees Over Time Trends In Higher Education The College Board Tuition Native American Spirituality College Board

Property Taxes By State County Lowest Property Taxes In The Us Mapped

These Are The Best And Worst States For Taxes In 2019

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Real Estate Real Estate Estates Bobvila Com

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

T T T Homes Are Aimed At Taking Your Living Experience To The Next Level T Home Club House Home